Crafting Mobile Experience Strategy for The North Face and Vans Apps @ VFC

🚨 How might we design an app experience that can increase consumer engagement, conversion, and build brand loyalty?

Team

Myself, Adam Beckley, Sean Sabihi, Claire Crookston & Carmen Ohen

Timeline

7 months, October 2021 - May 2022

Role

UX Researcher: synthesized 30+ stakeholder & 20 customer interviews, conducted heuristic evaluation for Vans and TNF apps, current state analysis based on industry performance, led two phases of competitive evaluation, researched mobile apps best practices, co-facilitated ideation workshops with stakeholders.

Methods

Stakeholder & Customer interviews, competitive analysis, heuristic analysis, usability testing, feature matrix, ideation workshops

Deliverables

Strategy document for brands, highlighting key insights and roadmap initiatives

Process overview

🧠 Discovery: stakeholder interviews, customer interviews, competitive analysis, heuristic analyses, qualitative surveys, reports on mobile trends & mobile behavior.

🔍The North Star Vision

🖊️ Concept to plan: feature ideation & prioritization, design sprints, and product roadmapping.

Background

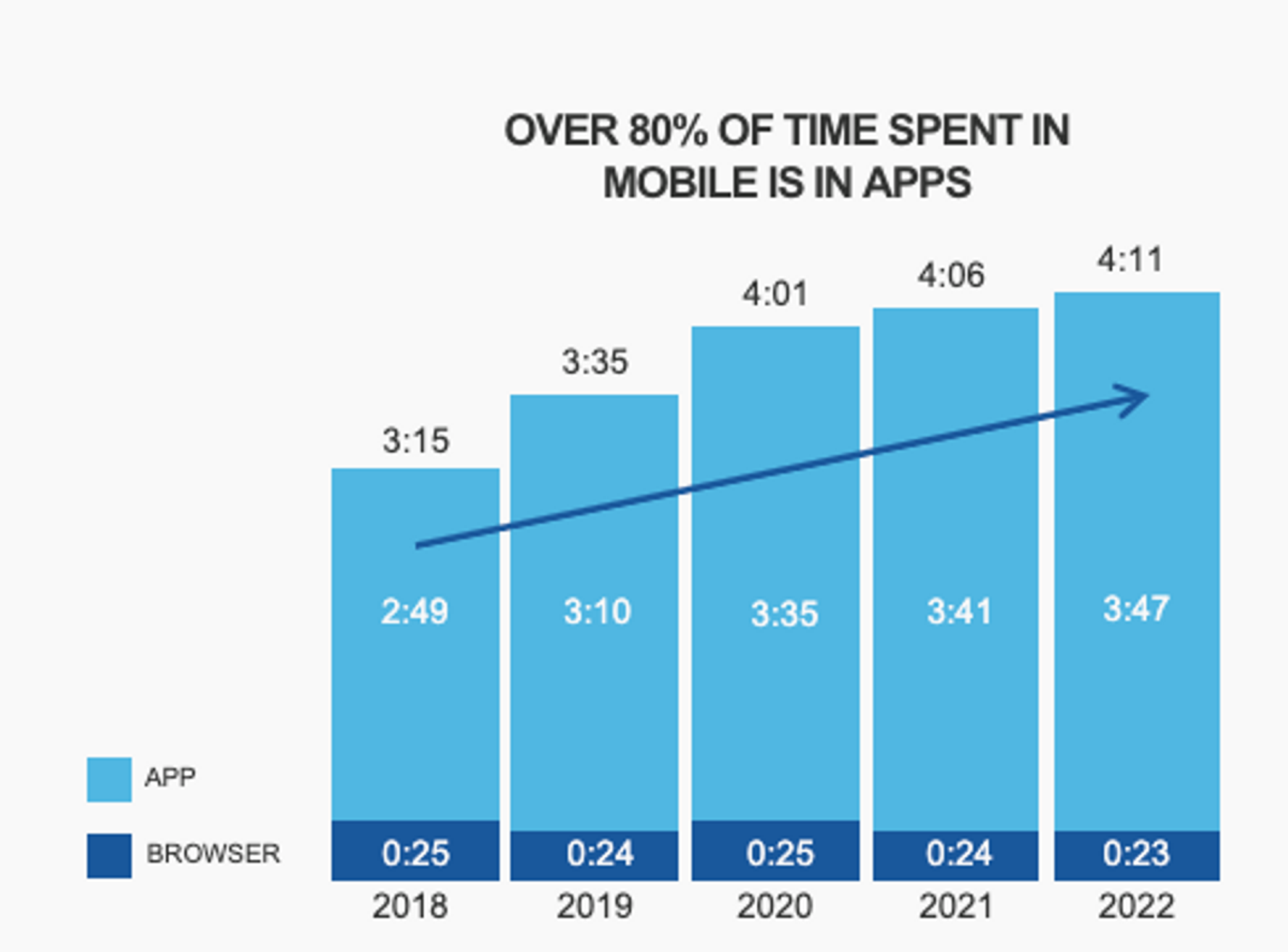

*This data was collected and synthesized by our business development analyst, Carmen OhenMobile app consumers are growing

Mobile apps, especially m-commerce apps, are increasing in growth, usage, relevancy, and importance for today’s consumer. In fact, mobile apps are the fastest growing channel in terms of orders. Mobile app usage is expected to continue growing while web is expected to stay more stagnant (see graph below).

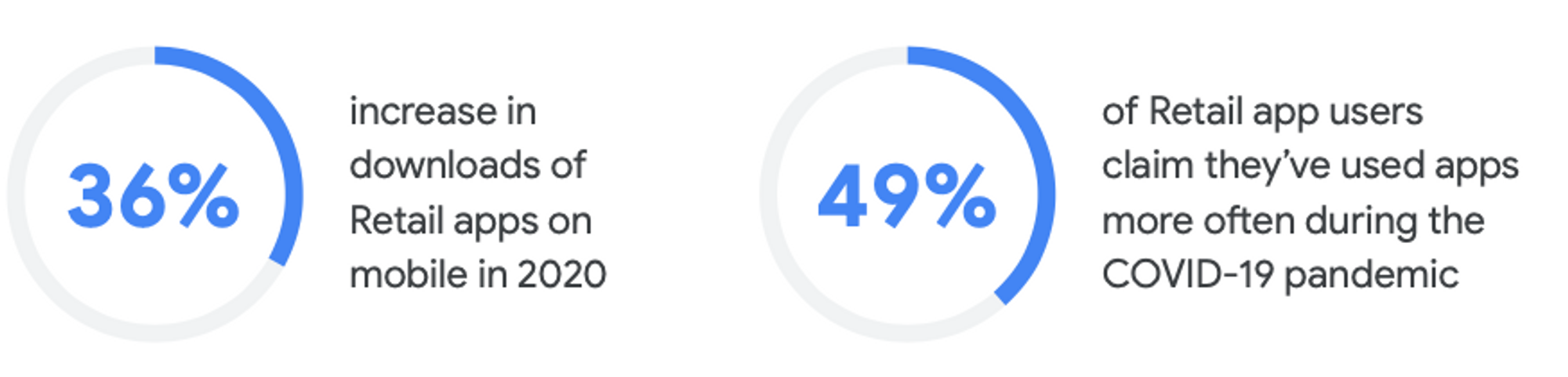

In 2020, there was increase in the frequency with which people use Retail apps, and the number of Retail apps they use. Almost half (49%3) of Retail app users claim they’ve used apps more often, and almost a third (31%4) of users claim they’ve used a greater number of apps than before the pandemic (Think with Google report below).

The COVID-19 pandemic has fueled mobile app adoption and elevated consumers’ expectations. With so many apps to choose from, competition is fierce and digital transformation is as important as ever.

The problem

Our apps have huge unmet potential

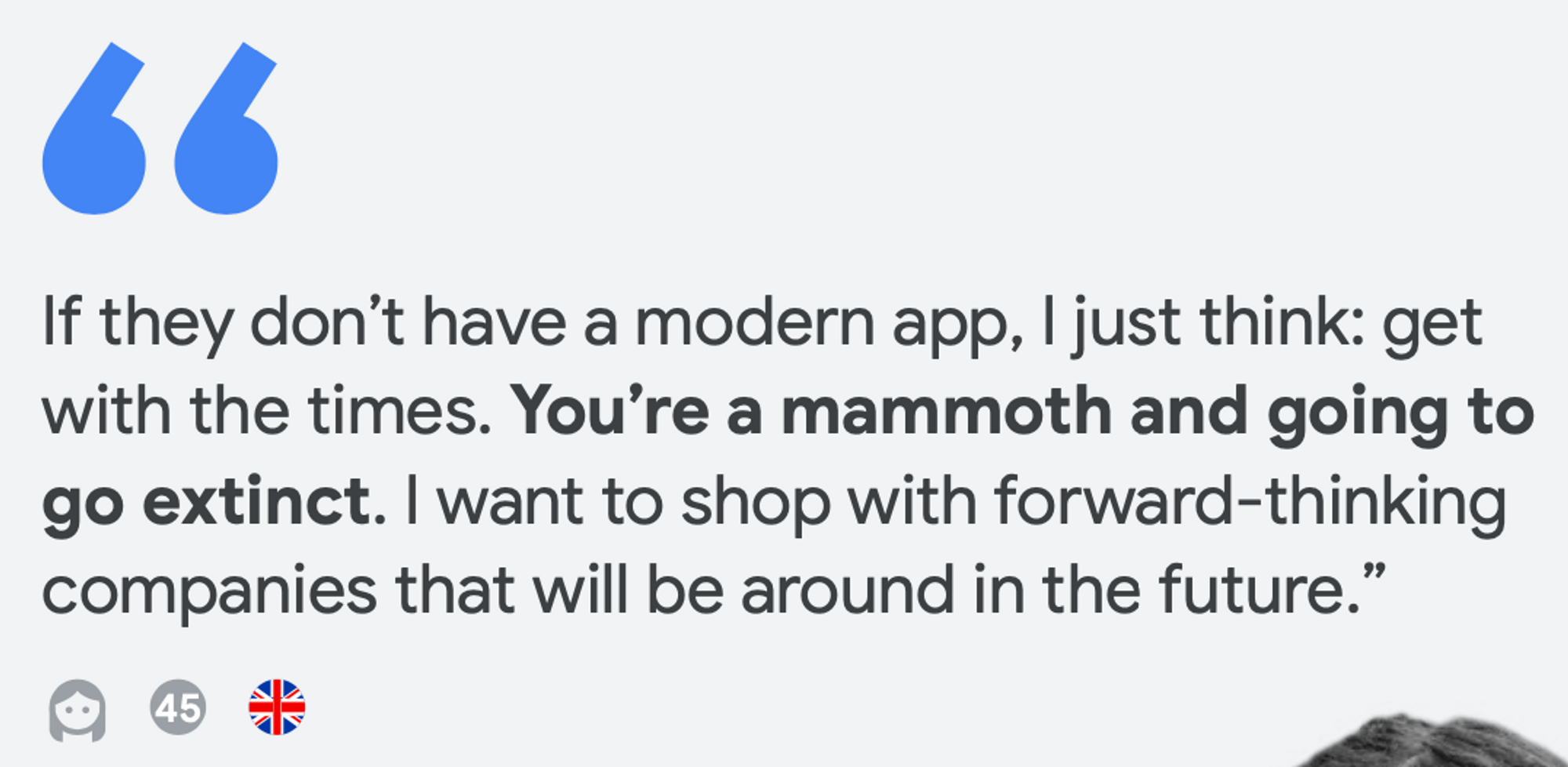

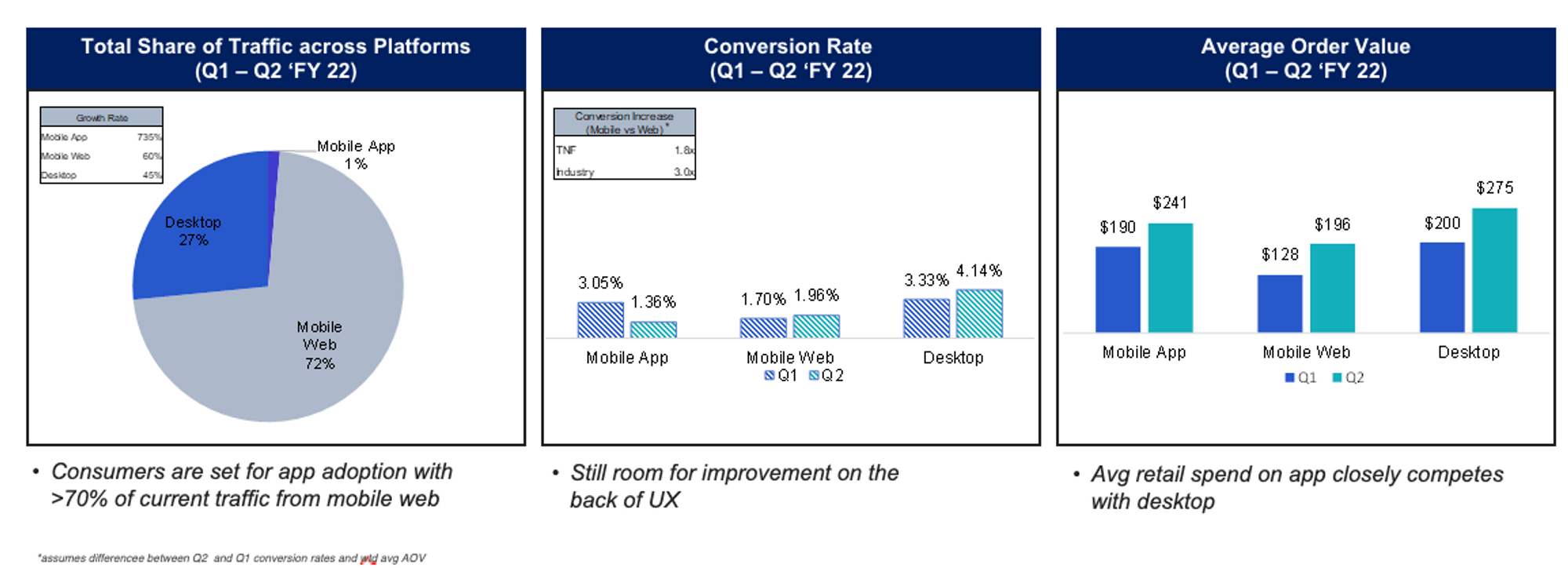

Not to bore you with all the numbers, but we’ve been able to pull data around traffic, conversion, and average order value (AOV) and compared this across the different platforms for TNF (desktop, mobile web, and mobile app).

Traffic: only 1% of the traffic came from mobile app.

Conversion: we are preforming about 1X below industry expectation.

Average order value: average retail spend on mobile app is close to desktop.

Competitors’ apps are driving engagement and stickiness

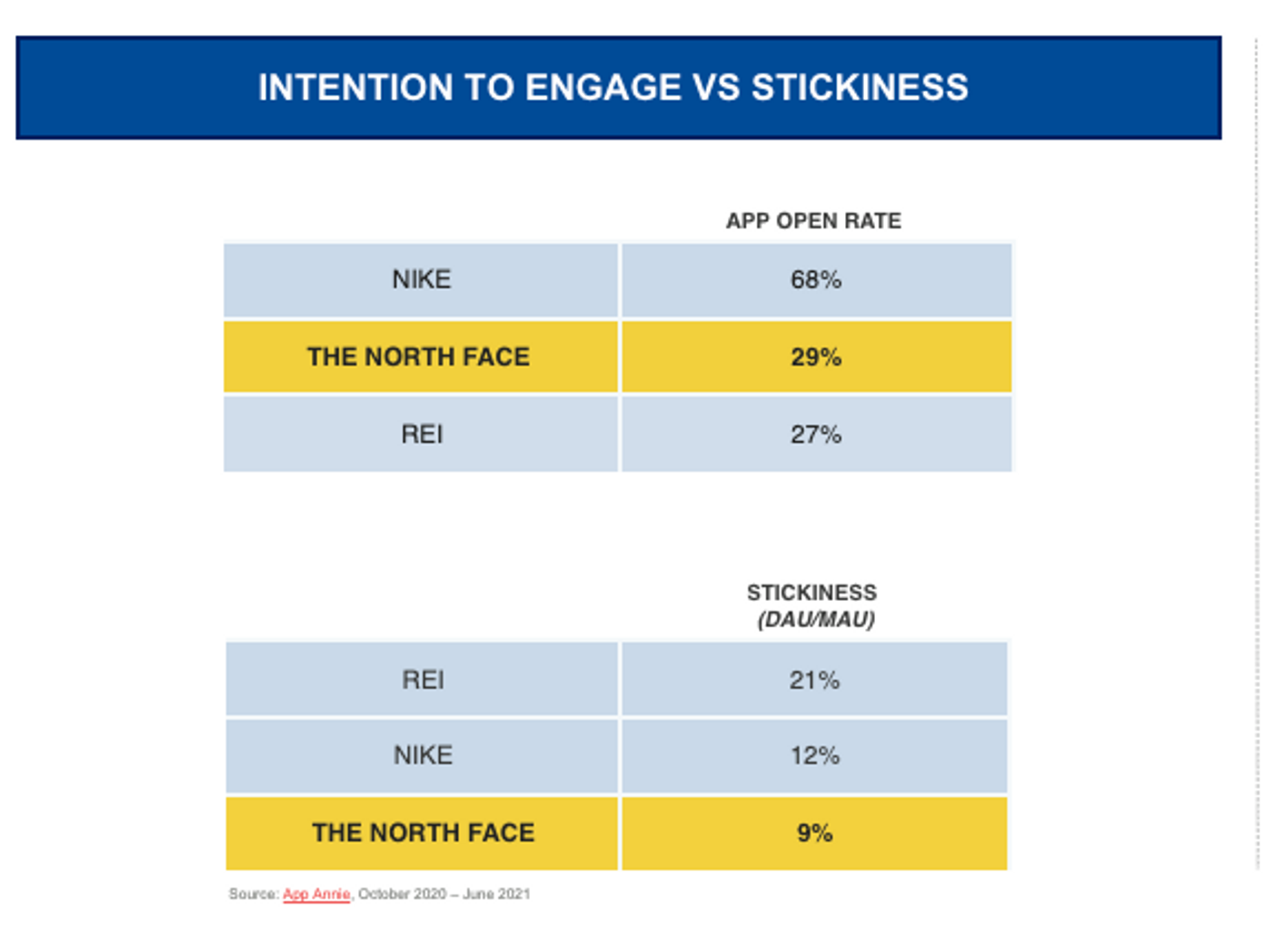

Moving on from conversion metrics, we did a comparison with two key competitors (Nike and REI) to see where we stood with our app’s open, engagement, and stickiness rates.

Open rates: the TNF app enjoys a competitive “open rate” of 29%, falling right in between Nike (68%) and REI (27%).

Engagement rates: TNF has an average session duration of 1:49, however the average session/user is at 2.92, meaning that the app is used less frequently but for longer periods of time. When compared to Nike and REI, we can see that the average session/user is much higher (9.81 and 8.43, respectively) and the average session duration is pretty much the same. Here, we see a huge gap between in our ability to keep our consumers plugged in and our competitors.

Stickiness rates: TNF app has a stickiness rate of 9%, ranking the lowest of all three.

TLDR

TNF app offers no added value beyond m-commerce. Although it has a competitive “open rate”, it is paired with low stickiness and session frequency, which indicates an opportunity to build more memorable, valuable, and relevant experiences to encourage users to come back.

TNF app has a frustrating user experience and lots of friction points, which reflects on the conversion rate. In fact, 42% of consumers complained about performance issues, while 24% reported log-in issues (Oct 20’ – June 21’).

Vans app doesn’t offer commerce, which is a huge missed opportunity.

Huge opportunity for increased revenue, conversion, engagement, and retention for both our brands

Discovery

-

Interviews 26 stakeholders across TNF & Vans, aiming to understand business priorities.

Themes for both brands included:Loyalty through community

Experiential & beyond transactional

Omni-channel

Exclusivity, content, and personalization (product recommendations, content, messaging, etc)

-

Interviewed 30 Vans and TNF consumers, aiming to understand their mobile habits, attitudes, and expectations.

Emerging themes include:

Convenient, saves my preferences, easy to navigate

Speedy, saves me time, quick and easy transactions

More personalized experience, deals, rewards

-

Read countless reports to understand key trends and consumer expectations.

Here’s what we found:

Seamless registration: Reduce friction and time taken to sign in/sign up (auto-fill & biometrics).

Meet user’s functional needs: Makes user’s lives easier and simpler.

Blending experiences: Blend online and in-store experiences to drive engagement (beacons, BOPIS (Buy Online Pickup In-store))

Loyalty and exclusivity: Drive loyalty with exclusive experiences (products, content, rewards, discounts).

Multi-sensory experiences: Engage in a more personal way through AR.

-

Conducted competitive analysis of 11 direct & in-direct competitors’ apps (Target, Starbucks, Amazon, Peleton, & AllTrails, Nike, REI, Lululemon, Adidas). Features under review were: onboarding, m-comm/UX flow, personalization, geolocation and deals, loyalty and rewards, gamification, and lastly a summary.

Target: Fuses loyalty, discounts and a digital catalog into a single platform to drive more sales volume, and ensure a seamless mobile payments (loyalty & omni-channel)

Amazon: Focus on in-app exclusivity, especially for Prime members. Easy checkout flow. Personalized recommendations based on order and search history.

Starbucks: Optimized toward earning more rewards signups, but it also provides practical features that directly benefit customers, like ordering drinks in advance for in-store pickup

Peleton: Engages users and consistently puts out relevant content that makes users want to come back.

Alltrails: User engagement heavily depends on user generated content. This gives the users a sense of giving back to the community.

Nike: Loyalty/membership value is quickly demonstrated through exclusive and early access to products.

Adidas: Tiered Loyalty program based on user engagement. Encourages users to “build your profile” during onboarding, to guarantee a personalized experience.

Lululemon: Focus on community which in turn drives loyalty and engagement.

REI: Offers value beyond m-commerce by successfully connect people to the outdoors through booking experiences on the app.

-

Unmoderated usability tests focused on: shopping, filtering, reviewing, checking out and adding a product to favorites. Brands under investigation: Lululemon, REI, Nike, Adidas, Allbirds, and TNF

Emerging pain points with our TNF app:

Search: Search doesn’t fit users’ mental model

Browse: Allows minimal autonomy over users’ browsing experience

Wishlists: Unable to create wishlists & don't know where to access them

Onboarding: Frustrated when there is too much required "information setup”

Checkout: Process is friction filed, 15+ steps, no progress bar, and no autofill.

Areas of improvement:

Personalization: How might we engage and personalize our users’ experience?

Brand-consumer (emotional connection): How might we build stronger brand loyalty by highlighting on our brand values?

-

In order to know where we’re going, we need to know where we’re currently at. For this current state analysis, I created the categories based on repetitve critical points (research triangulation).

Sign up, onboarding, app performance, checkout.

Value beyond m-commerce, omni-channel experiences, brand-consumer connection.

Personalization beyond first name, data privacy and permissions.

North Star Vision

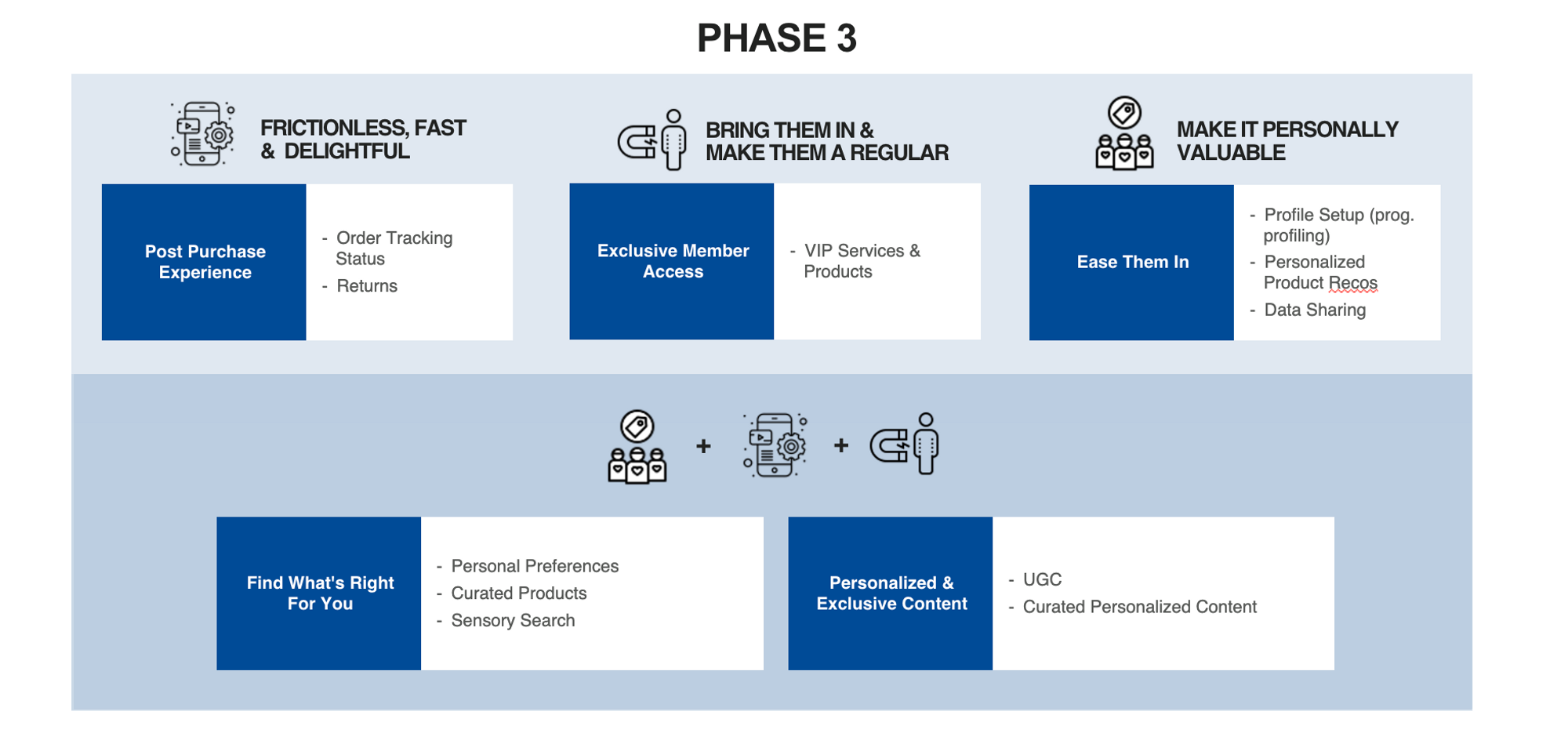

After defining wrapping up our discover, we brainstormed a North Star vision and themes.

Fast, Frictionaless, & Delightful Experiences

How might we build m-commerce for speed and ease to meet our consumers’ expectations?

How might we get people in and on with ease?

How might we ensure optimal usability?

Make it Personally Relevant

How might we innovate to consistently surprise and delight our consumers?

How might we personalize our users' experience to delight them rather than creep them out?

Bring Them in & Make Them a Regular

How might we maximize the individuality of our mobile apps to transcend transaction and ensure continued engagement?

How might we connect more deeply and build trust with our consumers to improve brand loyalty relationship?

How might we blend omni-experiences to meet users where they are?

Ideation and Prioritization Workshop with Stakeholders

At a high level, our board included: consumer needs, clips from our usability testing, stakeholder and consumer quotes, data from our qualitative survey, current state analysis, heuristic analysis, North Star thought starters, business case, and additional resources.

The workshop was split into 15 minutes of:

Deep dive into research

〰️

Individual ideation

〰️

Group discussion

〰️

Deep dive into research 〰️ Individual ideation 〰️ Group discussion 〰️

Following the ideation session, our stakeholders voted on all the ideas which influenced our phases. These phases also took into account the existing roadmap, development, and design bandwidth.

Reflections and takeaways

At the end of this project, I found myself very grateful for the lessons learnt. Firstly, stakeholder management has spotlighted the web of relationships that drive successful projects. Understanding diverse perspectives and aligning them toward common goals has been a profound learning.

Secondly, the art of influence without authority has been an invaluable skill to acquire. Navigating complex scenarios and leveraging persuasion to achieve outcomes has deepened my appreciation for the power of effective communication.

Lastly, research triangulation has broadened my research horizons. The convergence of multiple data sources to validate findings has proven indispensable in obtaining holistic insights and ensuring robust decision-making.

These learnings have transformed my approach, equipping me with the tools to navigate challenges, foster collaboration, and refine research practices. I look forward to applying these lessons to continuously elevate my professional journey 💼✨