Enhancing Return’s Customer Experience Across Vans, The North Face, & Timberland @ VFC

🚨 How might we design a better returns experience at Vans, The North Face (TNF), Timberland (TBL), and across 5 touchpoints?

Team

Myself, Adam Beckley, & Sean Sabihi

Timeline

4 months, June 2022 - October 2022

Role

UX Researcher, including: led and synthesized 10+ customer interviews, conducted historical research gap analysis, contextual investigation, and visualized study data to stakeholders

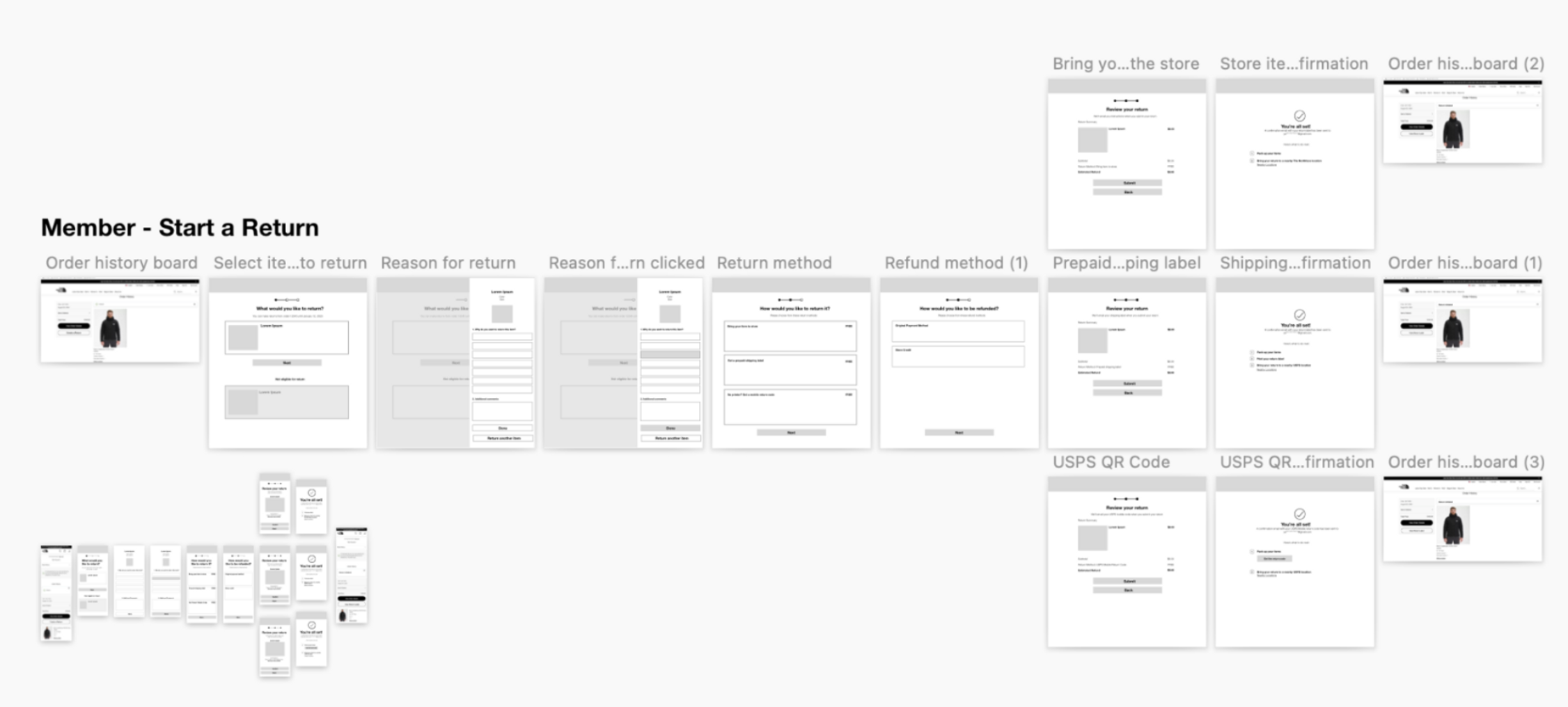

UX Designer, including: led customer journey mapping workshops, defined opportunities for improvement by identifying pain points, prototyped new return instructions, FAQ, and initiate return and track return portal for members (have accounts) and guests (no accounts)

Methods

Gap analysis (analysis of all historical research to determine unknowns), best practice research, 10+ customer interviews, competitive investigation, data visualization, and customer journey map

Background

To keep it short and sweet, VF’s returns experience sucked. Calls about returns were consistently in the top categories for the brands and consisted of about 15% of all customer service calls per month

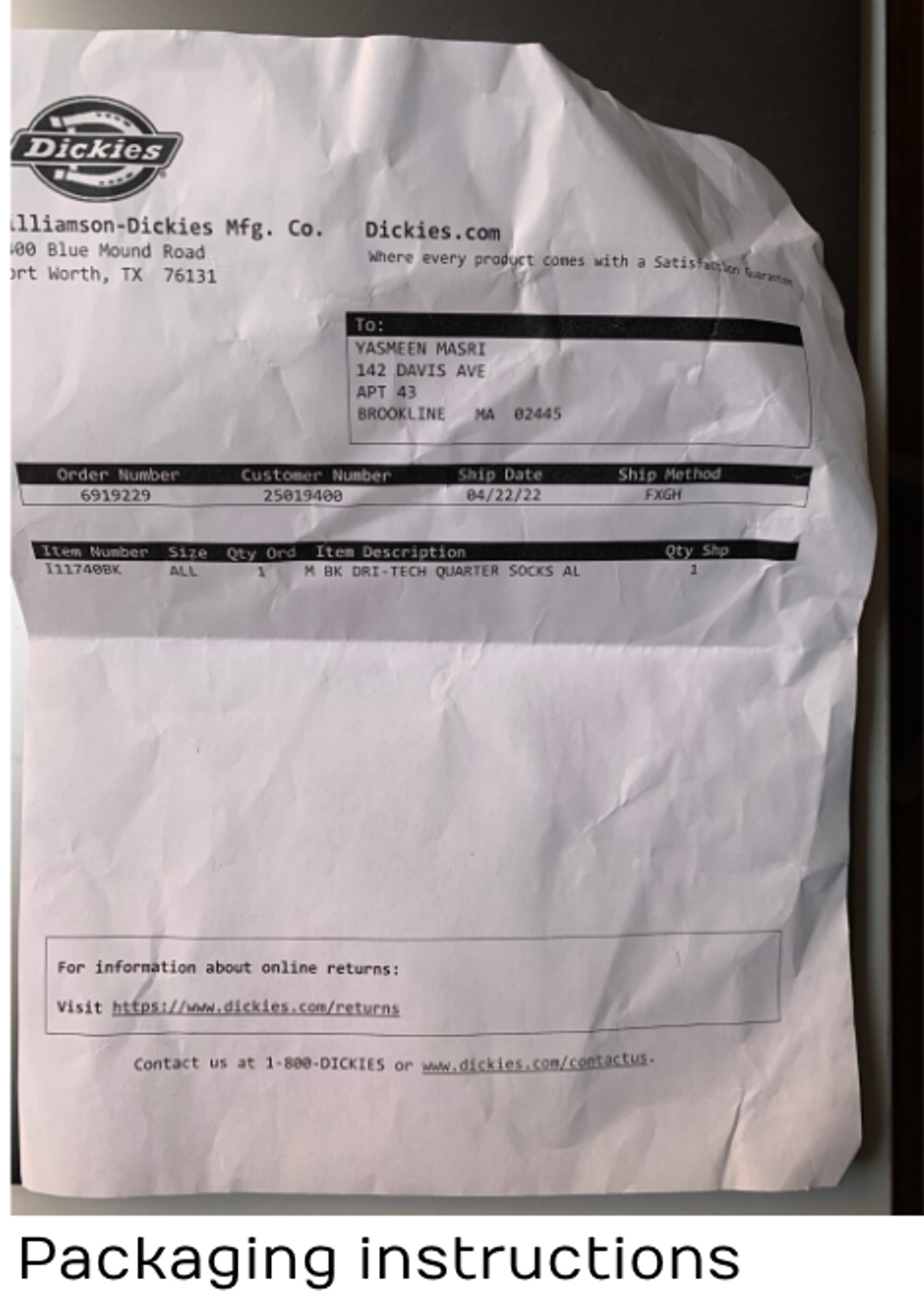

Instructions on how to return, how long returns take, and tracking for return packages are all information that customers can see on the websites; returns are seen as a self-service issue

Packaging instructions

Are there any instructions in the package?

Do instructions clearly inform me of what I have to do?

Define: So, what exactly is the problem?

We drafted an extensive customer journey map (of all 4 brands across 2 different regions) to comprehensively understand the journey that customers go through when returning with our brands.

We mapped out 5 steps: purchasing, receiving an order, initiating a return, track return, and receiving refund. Through the sentiment graph, we were able to understand where to prioritize our efforts and what parts of the experience needed to be improved.

Deliverables

Customer journey map, prototypes for new return instructions, FAQ, and initiate return and track return portal for members (have accounts) and guests (no accounts)

Process overview

🧠 Empathize: gap analysis, customer interviews, best practice research, competitive investigation

🖊️ Define: customer journey mapping

🎨 Ideate: opportunities and solutions

💻 Prototype: new return instructions, FAQ, initiate return and track return portal for members (have accounts) and guests (no accounts)

Pre-work work: Ideas for further investigation - Question, research method, impact

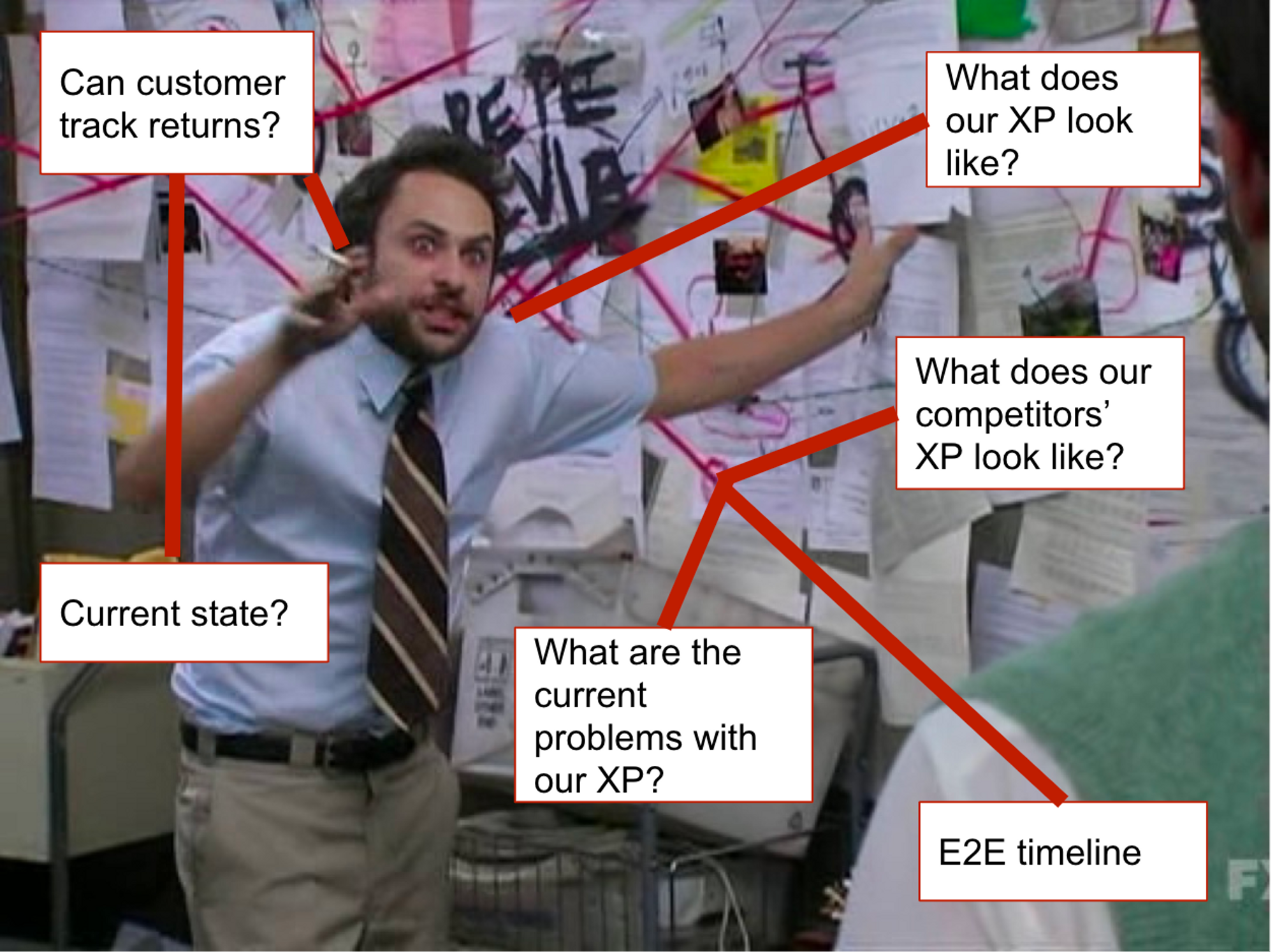

At the end of this board exercise, I had a good idea of what questions are answered and what questions need to be answered. To arrange my recommendations for further investigations, I constructed the diagram (right) to display:

question that needs to be answered

recommended research method

impact & priority v. effort

Next steps

〰️

Next steps 〰️

Our poor returns experience was negatively affecting customer experience and brand perception (left)

95% of customers say that a poor returns experience will make them less likely to shop with a brand again

SourcePre-work work: Gap Analysis - What do we know and what do we don’t know?

Over the years, many departments have attempted to improve the returns experience at VF, but none followed through.

As a result, there was a tremendous amount of historical research to sift through. To ensure that we didn’t duplicate efforts, I had to first understand what we know vs. what we don’t know about this space, by reviewing and analysis all past word, reading through documentation, market trends, and best practice

Here’s what it felt like sifting through all research and identifying areas of future research -> our next steps

Are you an ‘Always Sunny in Philadelphia’ fan? Let me know!Empathize: How do our customers feel, want, & expect?

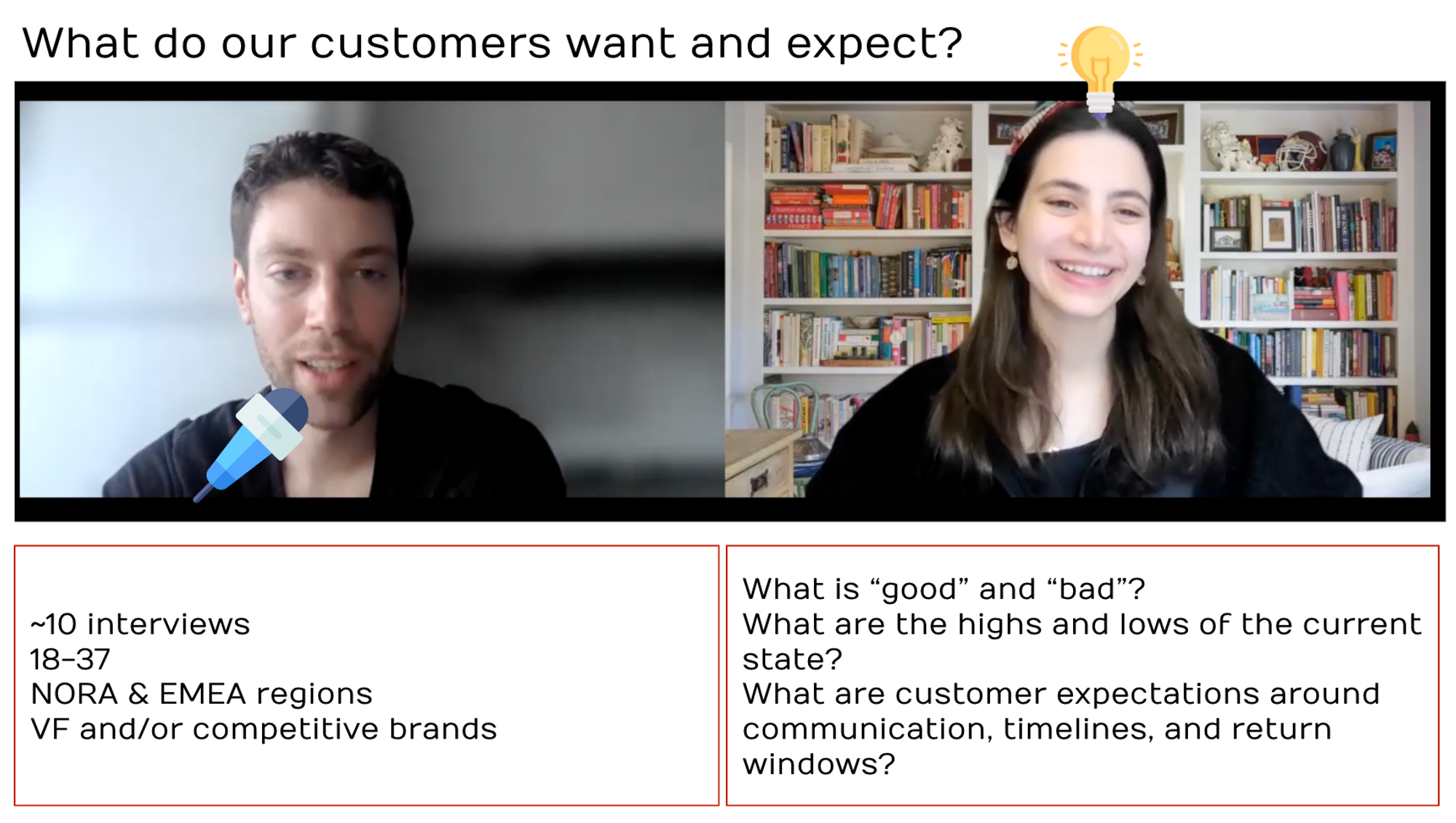

To better understand the gap in expectation, I interviewed ~ 10 people from North America and Europe, since VF is a global brand. I sought out to understand:

what is a “good” returns experience?

what is a “bad” returns experience?

what are the highs and lows of their experience

what are their expected timelines around brand communication, return windows, and refund timeline

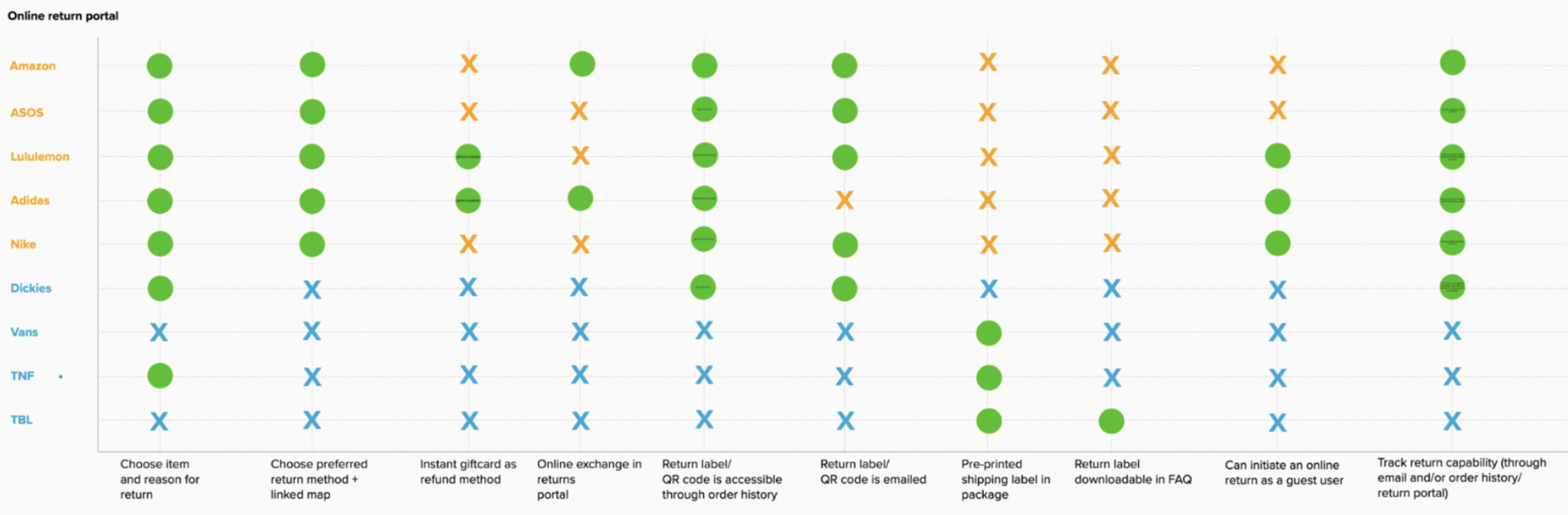

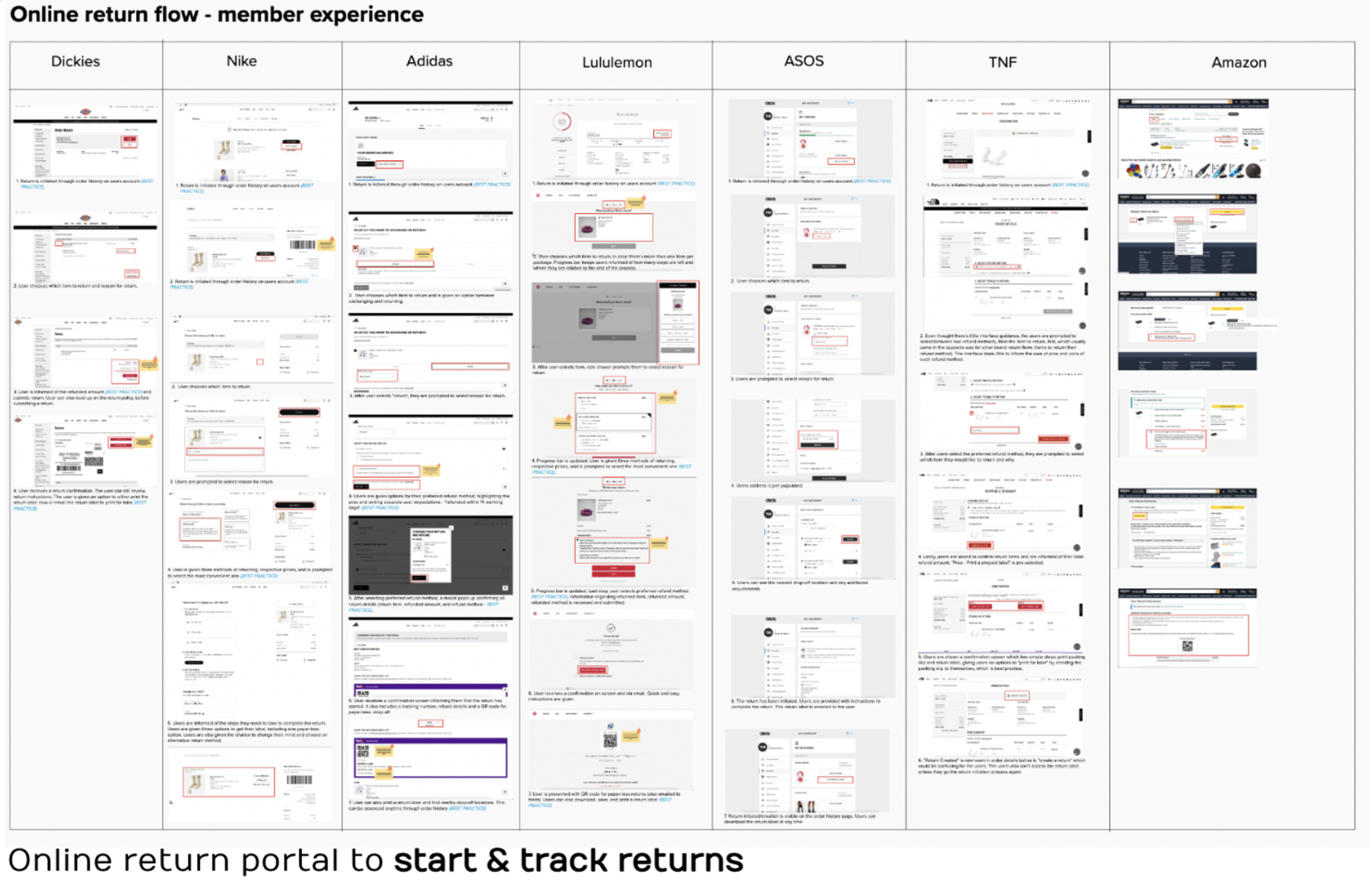

I translated the raw data (above) into a more visually impactful visualization (below), clearly indicating the brand & online return portal features. This helped guide and prioritize the team’s efforts

Mid-fidelity prototype (above)Interviews synthesis & insights: Six findings on customer needs and expectations

Seamless member experience: The customer expects to start a return through the order history and to be able to track their return via a tracking feature on their account.

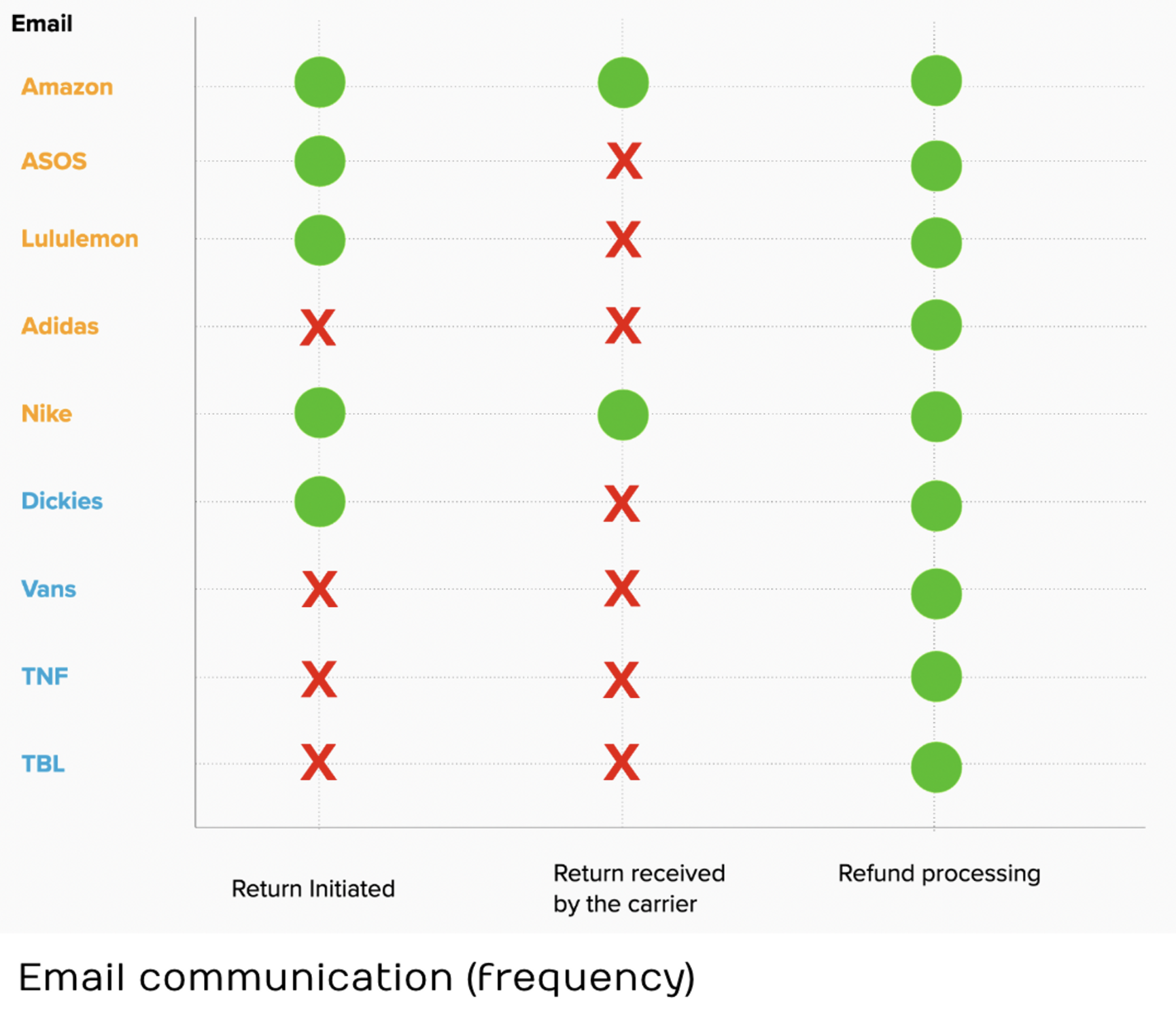

Email communications: Customers expect to be informed of their packages’ return milestones and any delays.

Return milestones: Testers agreed that they would be liked to informed on: when they start a return (usually this emails contains the return label), when the package is received by the carrier or distribution center, when the package/return is accepted, and when their refund is on the way

Completion of process: A return is complete only when they receive a refund

Refund timelines: Expected refund timeline varied depending on return method. 3 days for in-person return and ~2 weeks for carrier return

Return instructions: Return instructions should be easily readable, scannable, and available in as many areas as possible

Competitive evaluation: Time to put myself in customers’ shoes!

For this evaluation, I brought and returns items from all these brands to take note and track the experience across multiple touchpoints (ex. email communication, readability of instructions, refund timelines, etc).

This exercise gave me deep insight on our areas of opportunity and where we rank, in comparison to industry standards.

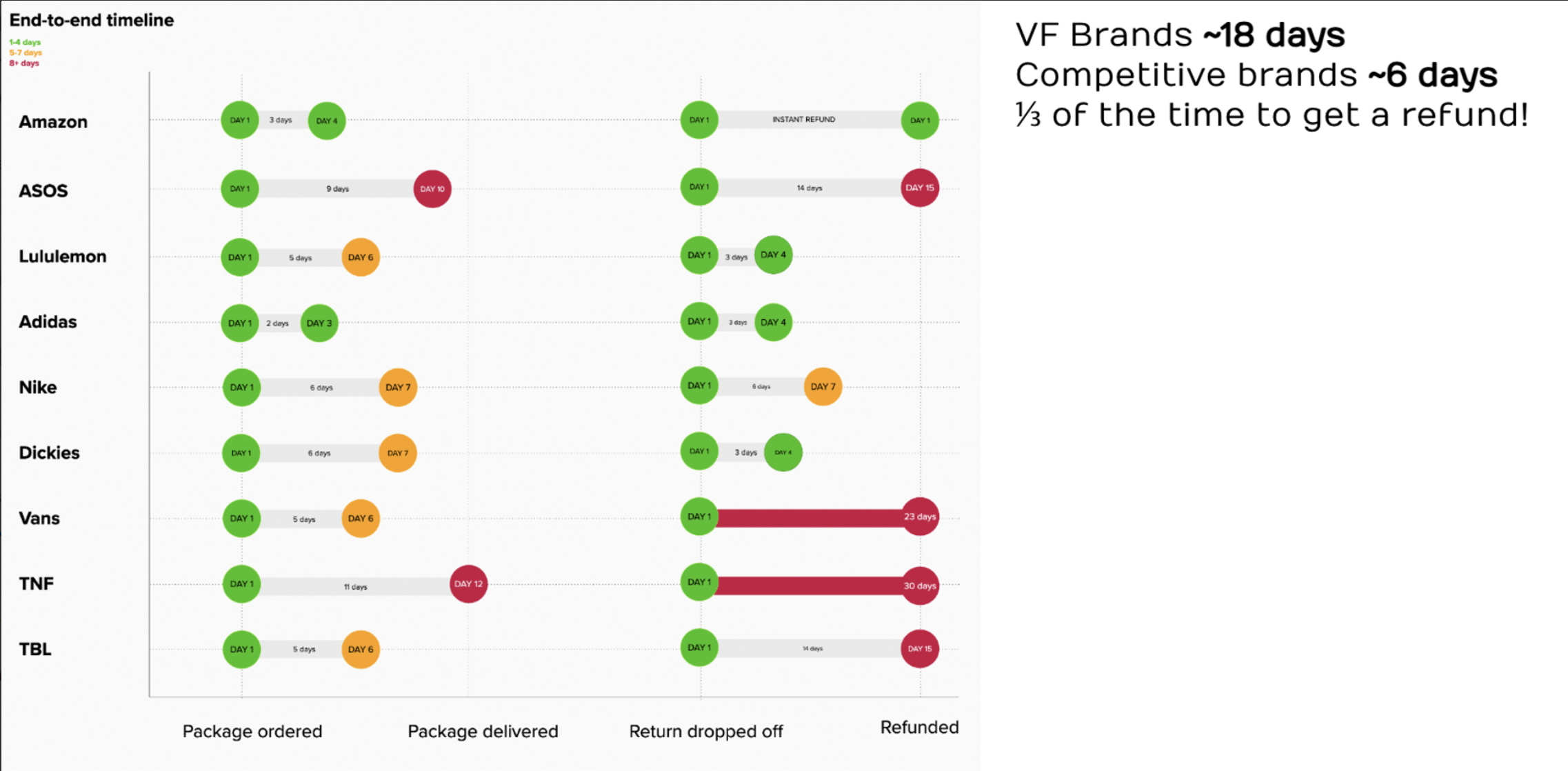

End-to-end timeline

How long does it take for me to get the refund?

Lastly, I tracked the time taken from package drop off till the refund. This helped us understand where we stand, compared to the industry.

VF brands ~18 days Competitive brands ~6 days

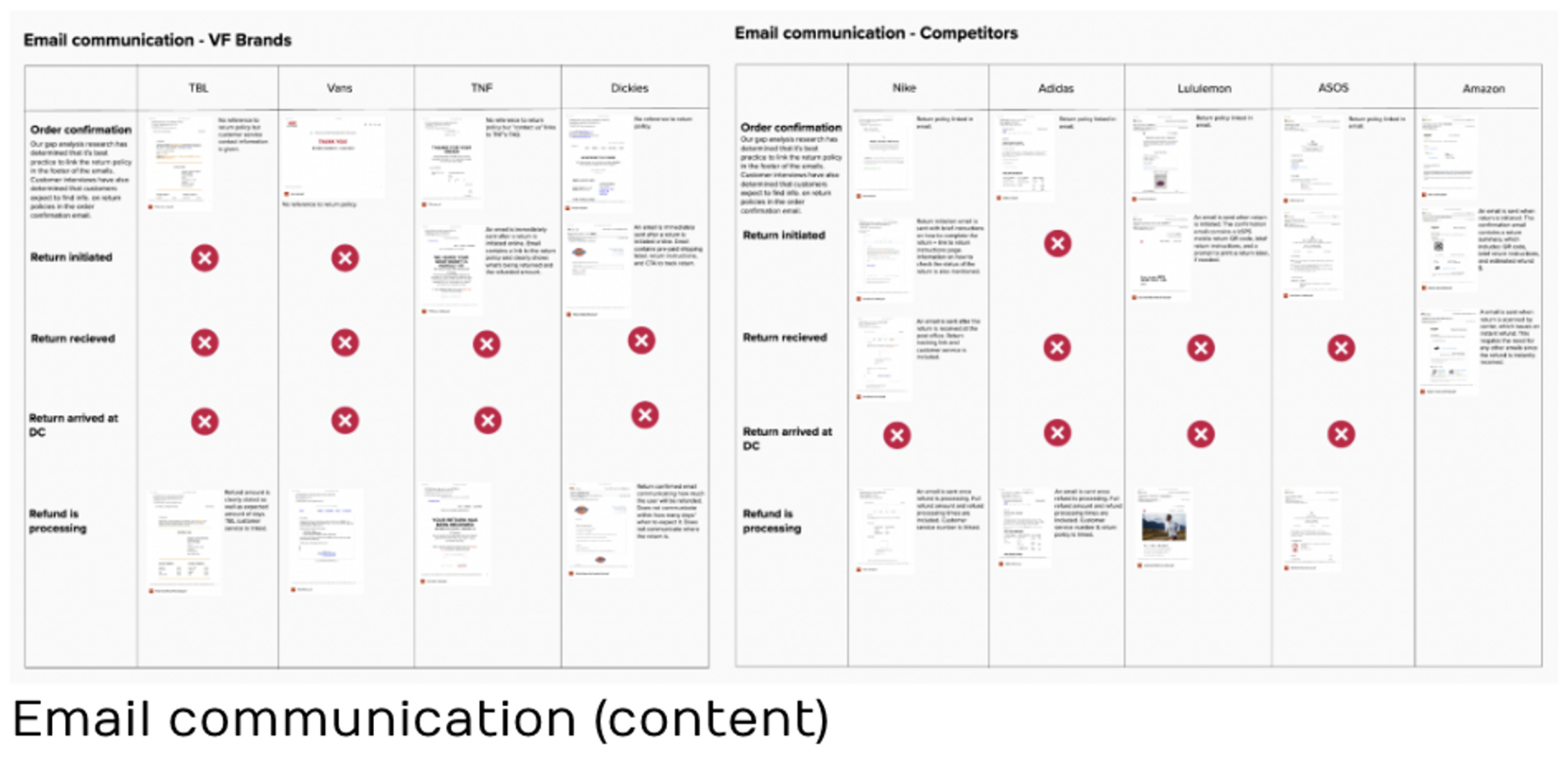

Email communication

What return milestones are communicated?

What information is in those emails?

I translated the raw data (left) into a more visually impactful visualization (right), clearly indicating the brand & the return milestone communicated. This was used to partner with brand marketing to improve communication.

Online portal to initiate and track returns

Can I start a return via my account?

Can I access my return label from my account?

Can I track my return via my account?

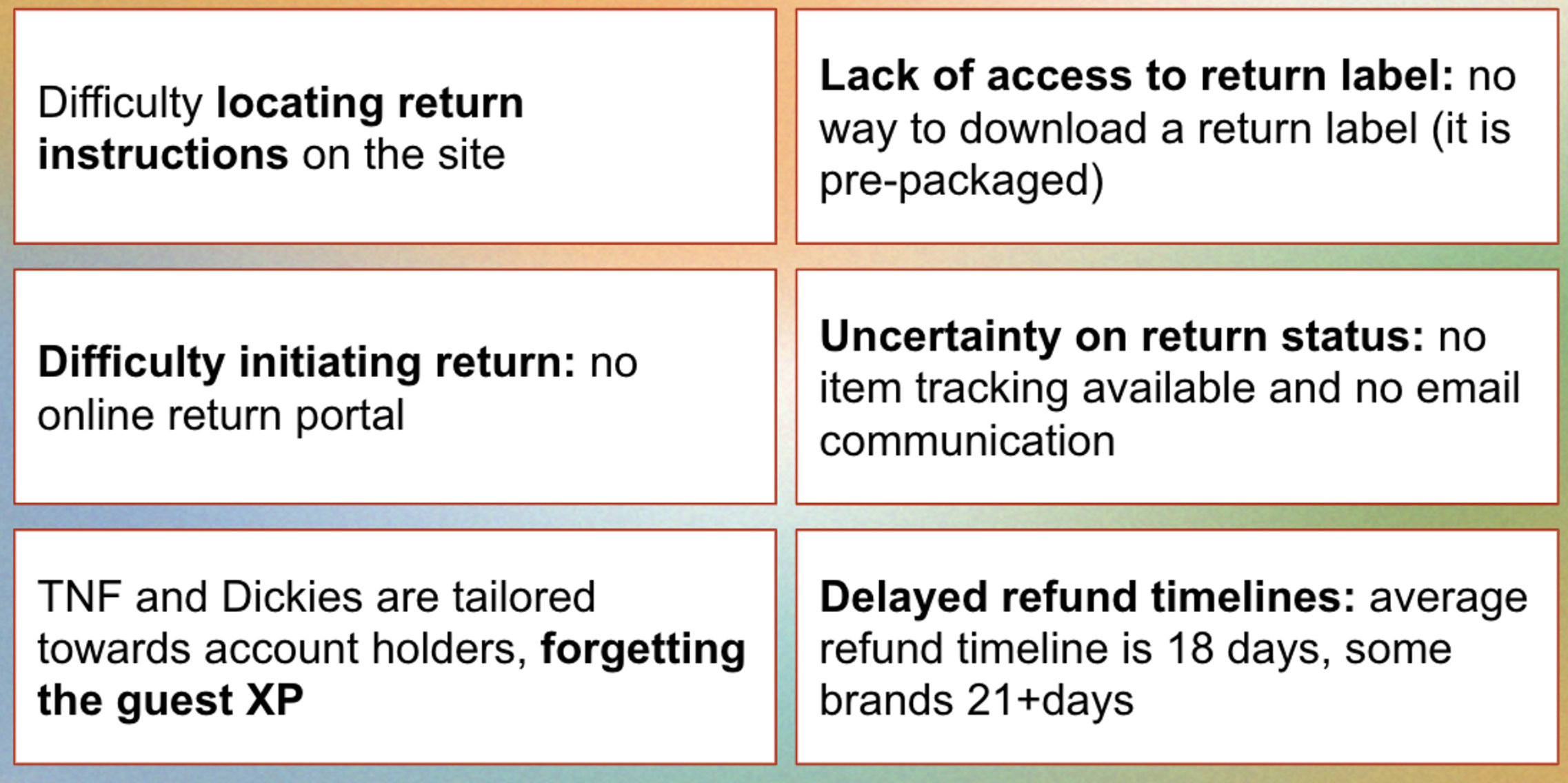

Pain points became increasingly clear

Return instructions were not easily accessible, readable, or scannable.

Since our brands had no online portals, customers were confused as the how they would start a return process (which is usually done online in their order history/account)

Brand didn’t offer a way for guest users to return. There was no guest portal was meant that this was an not an inclusive experience.

Because there was no online portal, this meant that our users couldn’t easily access a return label.

We didn’t offer a tracking capability. This leaves our customers worried about their package being lost or damaged.

Lack of tracking capability paired with extremely delayed refund timelines caused a lot of stress for our customers.

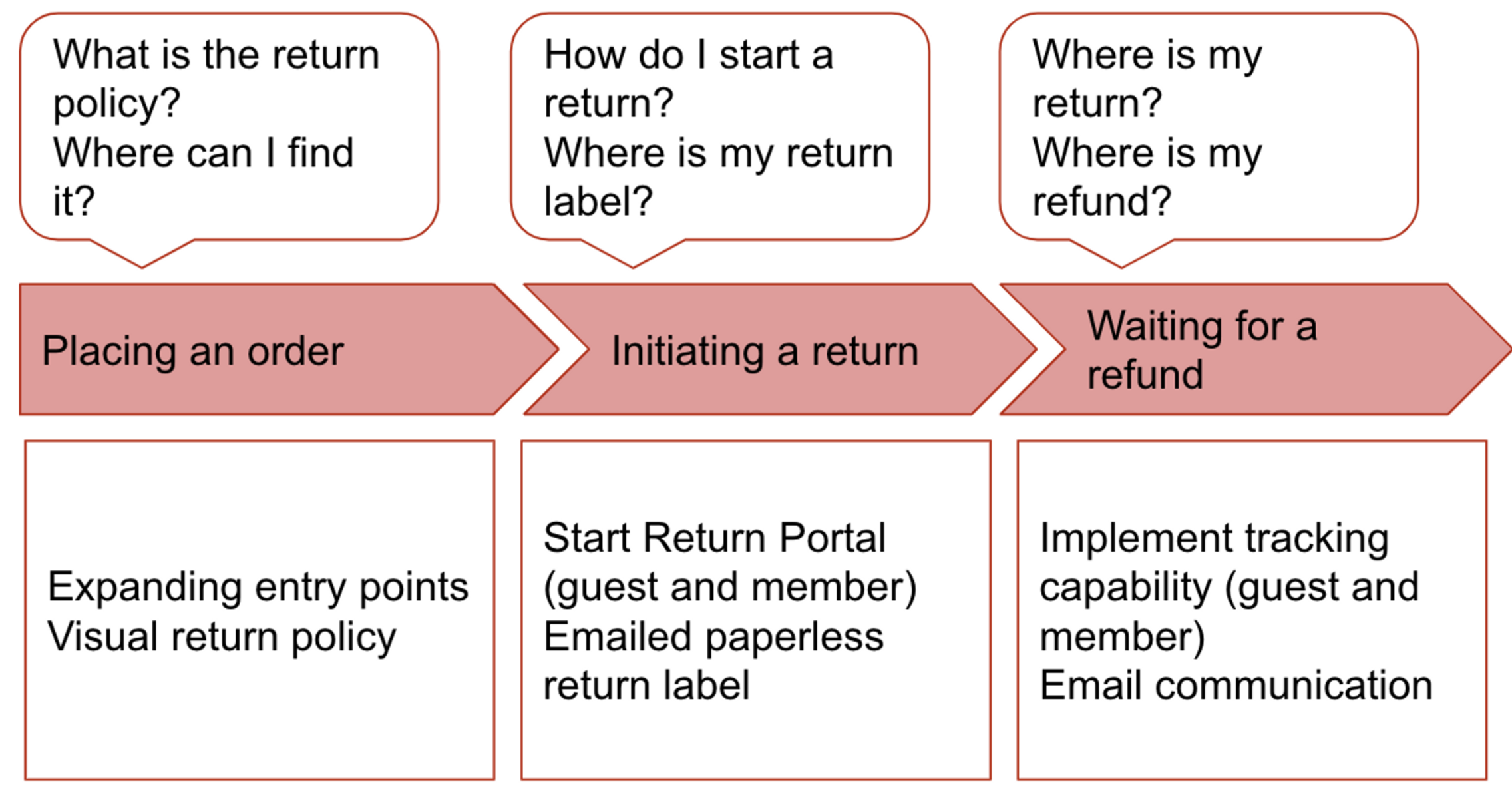

Ideate: What are some possible solutions?

After understanding the full scope of the problem, we defined some opportunities, ranging from low-hanging fruit to long-term goals, for each stage of the customer journey.

Placing an order: Expand the entry points to return policy (email footer, website footer, making it accessible through search). Making a more visual & scannable return policy.

Initiating a return. Implement online portal for guest and member (to track and start a return). Implement printerless return label s(QR code).

Waiting for a refund. Implement tracking capability. More frequent email communication on delays and milestones.

Prototype: What do the solutions look like?

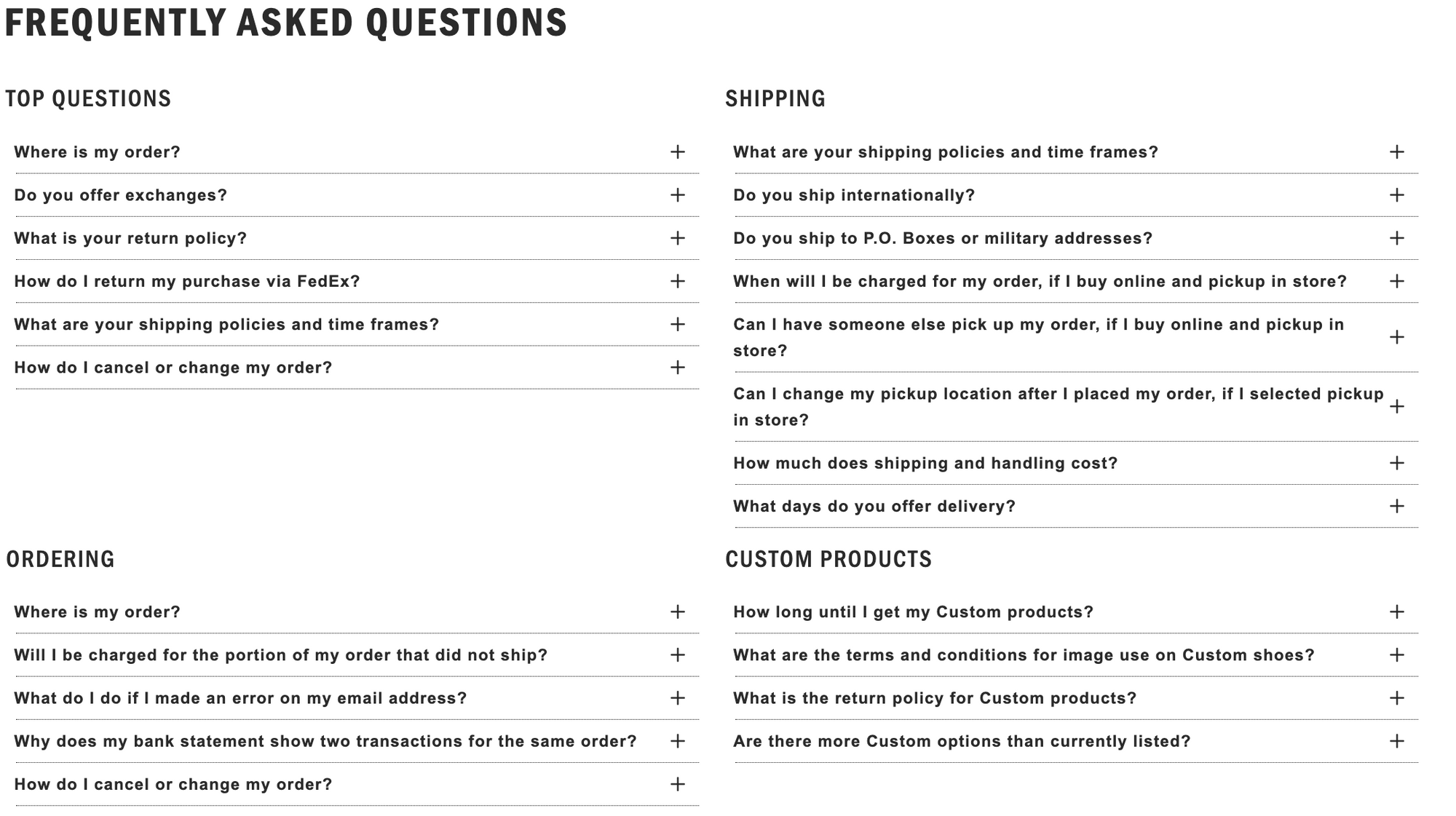

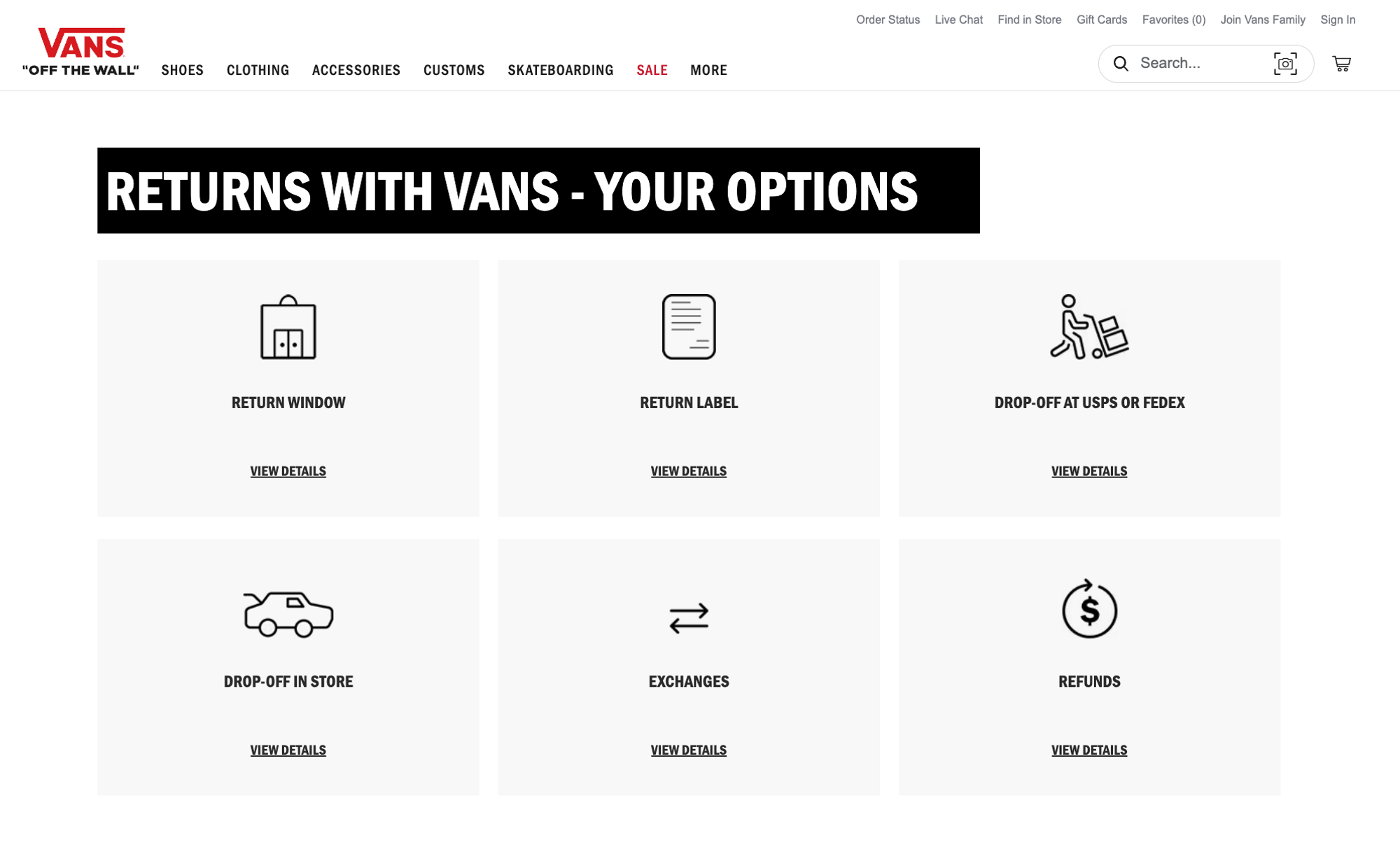

FAQ: Stronger visual design language and cleaner visual hierarchy (before vs. after)

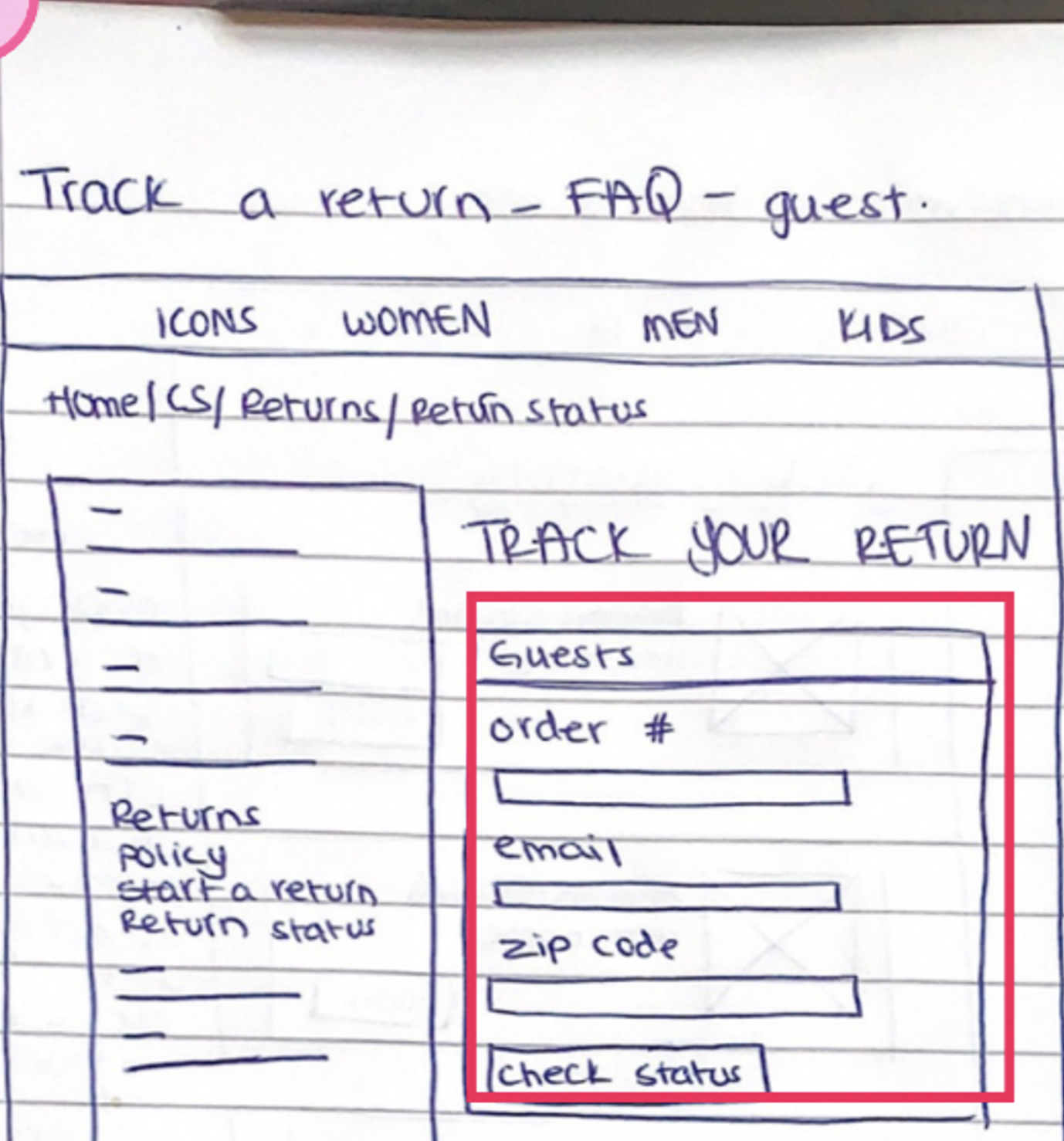

Online portal: Initiate or track a return as a guest or a member

Low-fidelity sketch (above)Reflection

My time at VF came to an end before the end of this project. Regardless, it was an incredible experience working with global brands. The things that I’ve learned throughout this experience include:

The power of good data visualization became apparent to me when I was constructing the Mural board with all the raw data about the brands email communication, online portal features, etc. I knew I had to find a better way to visually capture all the data I was finding. The resulting data visualization boards were impactful and resonated with so many people at VF. I saw the board being included in presentations to leadership and I received multiple emails requesting to share my board with people I didn’t know!

Add your own twist to research methods and think outside of the box! I learned this during my competitive evaluation - which inspired me to take my competitive evaluation one step further and actually buy and return items from all nine brands. Even though this took more time and effort, I believe it was worth it because the depth of information that I got out of that was instrumental to the progression of this project.